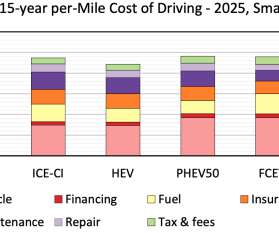

Argonne study finds BEVs can have lowest scheduled maintenance costs, but highest cost of driving

Green Car Congress

JUNE 15, 2021

The study considers five different powertrains (internal combustion engine, hybrid-electric, plug-in hybrid-electric, fuel-cell-electric, and battery-electric) and 12 cost components (purchase cost, depreciation, financing, fuel, insurance, maintenance, repair, taxes, registration fees, tolls and parking, payload capacity and labor).

Let's personalize your content