Replacing Fuel Tax A Government Quandary

CleanTechnica EVs

JULY 17, 2024

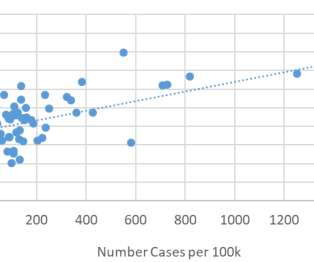

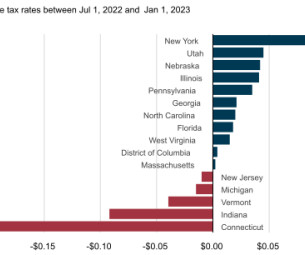

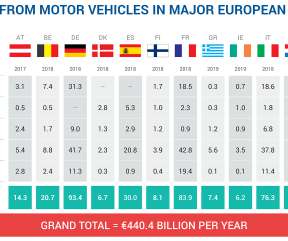

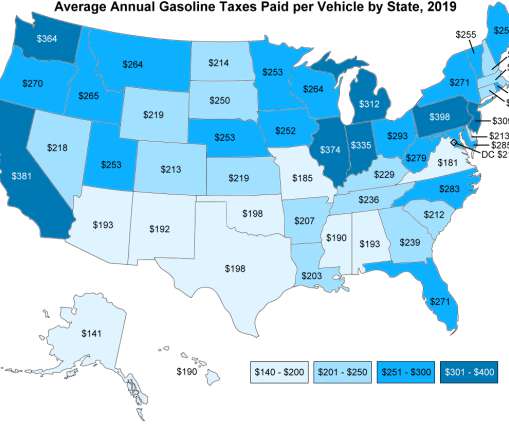

Election promises of more services and less taxes are ludicrous. So, as the proportion of electric cars on the roads rise, what will fill the funding gap left by the loss of petrol and diesel tax? continued] The post Replacing Fuel Tax A Government Quandary appeared first on CleanTechnica.

Let's personalize your content