How Corporations Can Help the U.S. Reach its EV Goals

Clean Fleet Report

SEPTEMBER 10, 2023

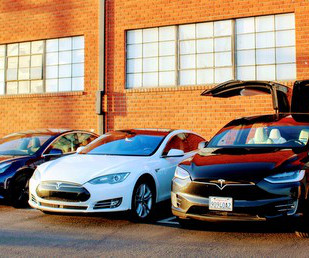

How Corporations Can Help the U.S. The general assumption seems to be that Americans will simply ditch their gasoline-powered vehicles in favor of EVs. Meanwhile, the electrification of city- and corporate-owned vehicles has been dominating recent headlines. News and World Report recently posed the question: will the U.S.

Let's personalize your content