How Corporations Can Help the U.S. Reach its EV Goals

Clean Fleet Report

SEPTEMBER 10, 2023

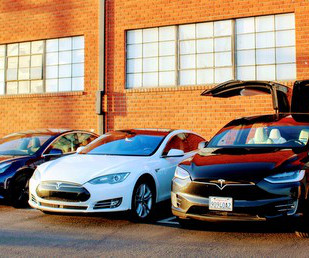

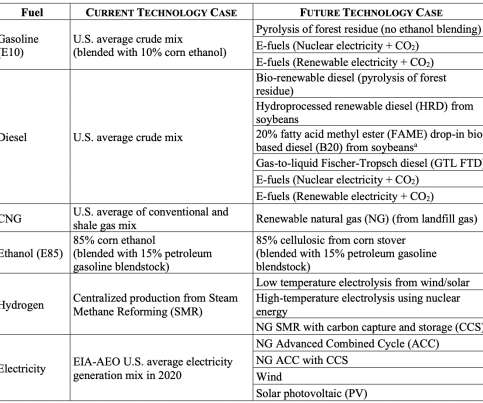

How Corporations Can Help the U.S. Meanwhile, the electrification of city- and corporate-owned vehicles has been dominating recent headlines. And large corporations like Amazon aren’t the only ones currently converting their fleets from gas to electric. Reach its EV Goals A Look at the Pathway & Companies’ Role U.S.

Let's personalize your content