IEA forecasts global oil demand to reach 101.6 mb/d in 2023; non-OECD countries lead expansion

Green Car Congress

JUNE 18, 2022

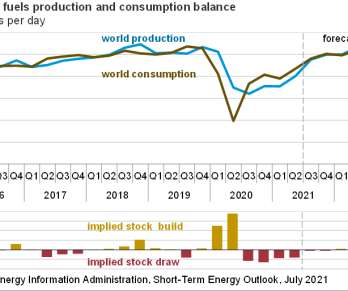

The IEA June 2022 Oil Market Report (OMR) forecasts world oil demand to reach 101.6 mb/d in 2023, according to the forecast. Non-OPEC+ is set to lead world supply growth through next year, adding 1.9 Following nearly two years of declines, observed global oil inventories increased by 77 mb in April.

Let's personalize your content