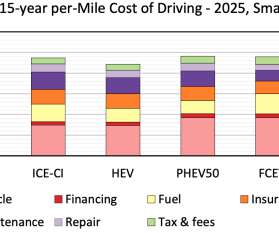

DOE labs study on costs and benefits of new transportation technologies the most comprehensive to date

Green Car Congress

AUGUST 14, 2021

Key findings include insights into vehicle depreciation, an in-depth examination of insurance premium costs, comprehensive maintenance and repair estimates, an analysis of all relevant taxes and fees, and considerations of specific costs applicable to commercial vehicles.

Let's personalize your content