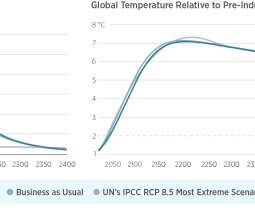

Study finds limiting warming to 2 °C would require at least a $200/t carbon tax globally

Green Car Congress

MAY 6, 2022

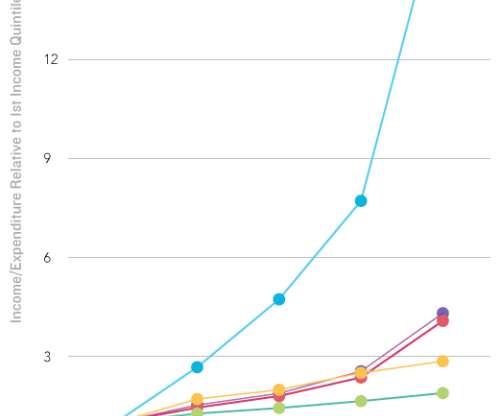

The social cost of carbon has become the standard measure to benchmark the magnitude of the carbon taxes needed to implement optimal carbon policy. If we were able to measure this social cost accurately, standard Pigouvian logic tells us that the optimal tax should be such that the price of carbon is equal to this social cost.

Let's personalize your content