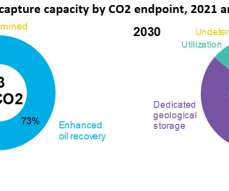

BNEF: global carbon capture capacity due to rise sixfold by 2030

Green Car Congress

OCTOBER 18, 2022

The “Inflation Reduction Act” passed in the US increased tax credits for CCUS by 70%, making a viable business case for the technology in petrochemicals, steel, cement, and in some regions, power. But removals are present in every long-term net-zero model. This 279 million tons of capacity in 2030 is just the tip of the iceberg.

Let's personalize your content