Fisker scraps direct sales and turns to auto dealers for sales

Teslarati

JANUARY 11, 2024

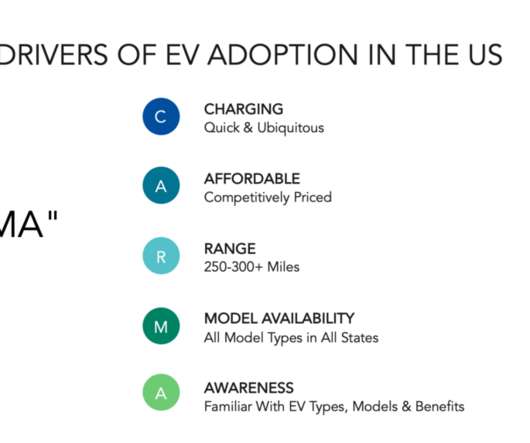

Fisker is scrapping plans for direct sales to customers. The startup is now turning to auto dealerships for sales and services. IRA EV tax credits winning over more auto dealers in 2024 During CES 2024, Henrik Fisker told Automotive News that the electric vehicle (EV) manufacturer intends to sign with 50 car dealerships by the midyear.

Let's personalize your content