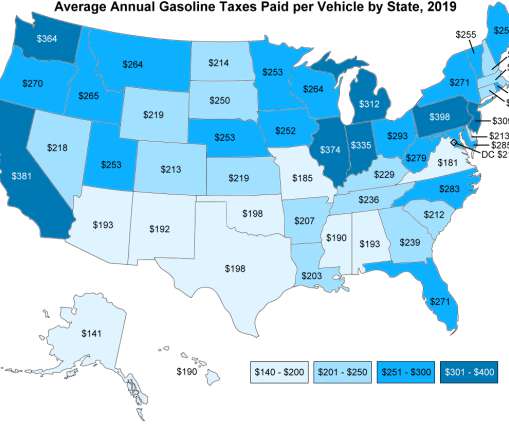

DOE: Average annual gasoline taxes paid per vehicle, by state, 2019

Green Car Congress

DECEMBER 3, 2019

The Federal tax on gasoline is 18.4 cents per gallon, and each state has a gasoline tax, ranging from 8.95 Since taxes are charged on a per-gallon basis, someone with a more efficient vehicle will pay less in taxes over the course of a year. miles per gallon (mpg) and the average annual miles driven is 11,484 miles.

Let's personalize your content