Proposed Changes to Federal EV Tax Credit – Part 2: End of the Manufacturer Sales Phaseout

EV Adoption

AUGUST 18, 2021

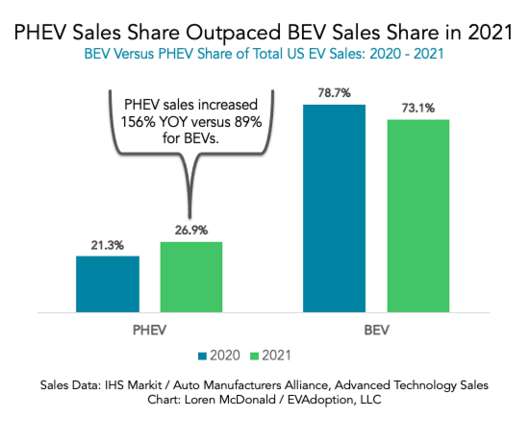

Arguably the biggest flaw in the Plug-In Electric Drive Vehicle Credit ( IRC 30D ) regulations is the triggering of a phaseout schedule of the tax credit when a manufacturer sells 200,000 total EVs (BEV and PHEV). Elimination of the Manufacturer 200,000 EVs Sold Phaseout Threshold.

Let's personalize your content