Study finds limiting warming to 2 °C would require at least a $200/t carbon tax globally

Green Car Congress

MAY 6, 2022

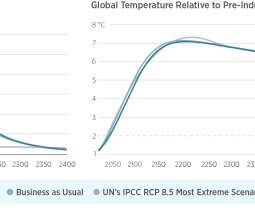

All regions of the world do not—and will not—experience the effects of CO 2 emissions in the same way. They find that while the distribution of carbon reduction pledges in the Paris Agreement is roughly in line with the LSCC, the pledges have only a very small impact on reducing emissions and limiting warming.

Let's personalize your content