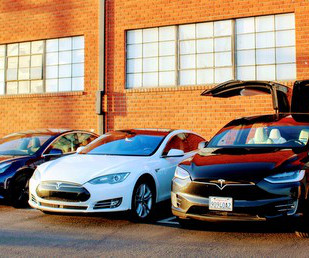

How Corporations Can Help the U.S. Reach its EV Goals

Clean Fleet Report

SEPTEMBER 10, 2023

How Corporations Can Help the U.S. As of 2017 , commuting to and from work accounted for 30 percent of all miles of passenger travel driven at the local level in the U.S. Meanwhile, the electrification of city- and corporate-owned vehicles has been dominating recent headlines. reach 50 percent EVs by 2030 ? percent) and men (64.7

Let's personalize your content