US Treasury delays EV battery guidance, more vehicles could qualify for 2023 tax credits

Electrek

DECEMBER 19, 2022

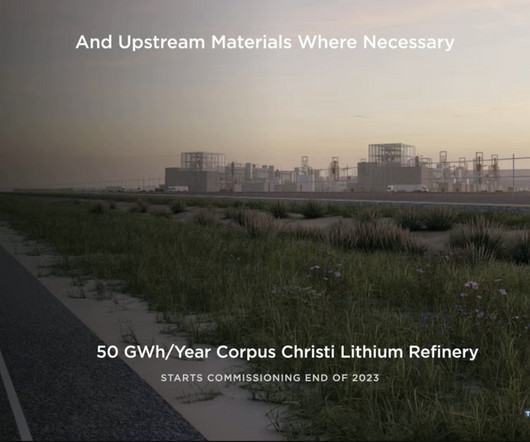

The United States Treasury department announced it will delay its guidance in regard to the sourcing requirements for battery materials in order for EVs to qualify for federal tax credits. The post US Treasury delays EV battery guidance, more vehicles could qualify for 2023 tax credits appeared first on Electrek.

Let's personalize your content