This Volkswagen EV Now Comes with Full Tax Credit Benefits

The Truth About Cars

JANUARY 30, 2024

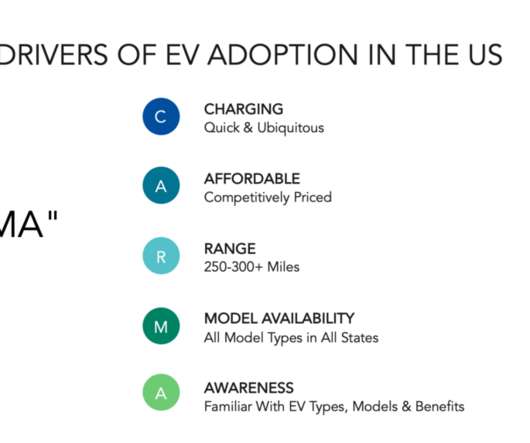

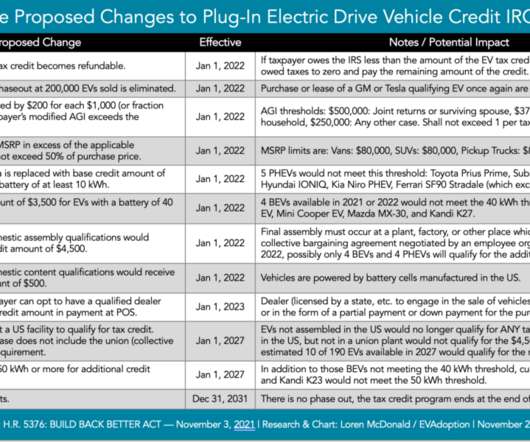

Photo credit: Volkswagen Volkswagen has recently announced that their MY23 and the upcoming MY24 models of the ID.4, 4, equipped with SK On battery components, will be eligible for the full $7,500 Federal Tax Credit. that qualifies for the full Federal Tax credit. This development makes these models of the ID.4,

Let's personalize your content