PHEVs and oil demand, Porsche charging, point-of-sale tax credit: Today’s Car News

Green Car Reports

JUNE 13, 2024

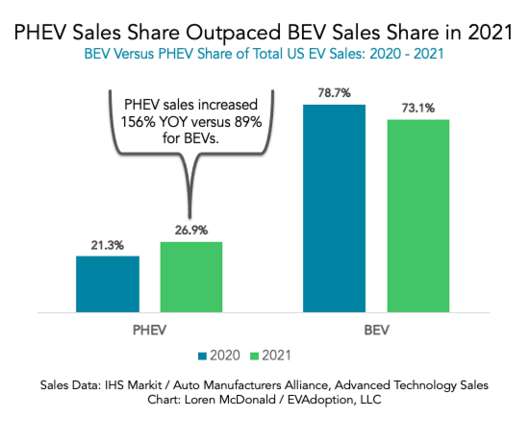

The point-of-sale EV tax credit is very popular. And are plug-in hybrids potentially adding to future oil demand? With the release of its annual EV sales outlook, Bloomberg New Energy Finance suggests that plug-in hybrids are a wild card for oil demand. Porsche adds thousands of chargers to its app.

Let's personalize your content