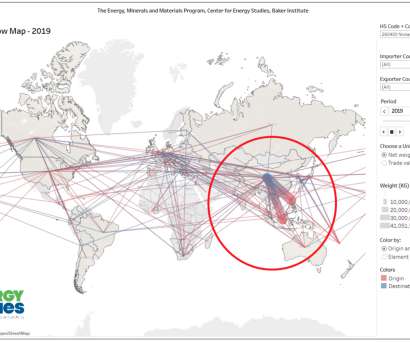

Baker Institute report: China has positioned itself as a gatekeeper to the energy transition; nickel case study

Green Car Congress

APRIL 21, 2022

Based in China, Tsingshan operates the world’s largest nickel syndicate—including nickel ore mining, nickel refining, purification, ferronickel production, crude steel production, logistics, port management, trading and transportation.

Let's personalize your content