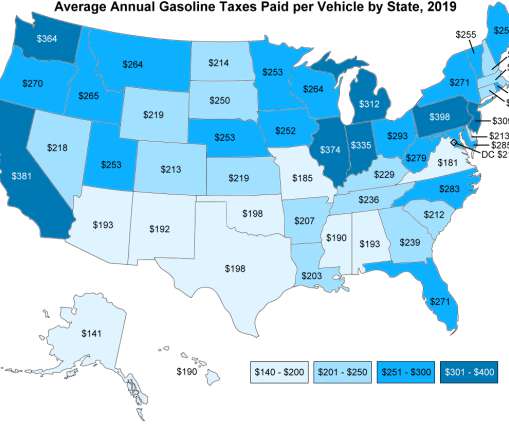

Could an "electric fuel" tax for EV use help states solve the gas-tax dilemma?

Green Car Reports

MARCH 7, 2021

The gas tax remains one of the main funding sources for road infrastructure, which has led to cries that electric-car drivers aren't paying their fare share of road maintenance costs. Consider electricity a fuel. A new bill circulating through the Minnesota legislature calls for an "electric fuel" tax for EVs.

Let's personalize your content