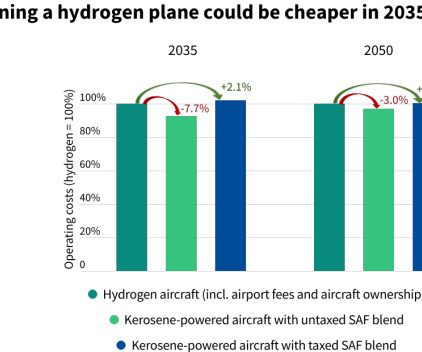

ICCT study urges taxing frequent fliers to decarbonize aviation fairly

Green Car Congress

SEPTEMBER 29, 2022

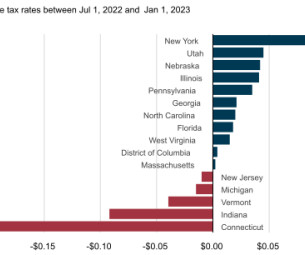

A tax on frequent flying could generate revenues needed to deeply decarbonize aviation through midcentury while concentrating the cost burden on those who fly the most, according to a new study from the International Council on Clean Transportation. The FFL is designed to place an escalating tax burden on people who fly frequently.

Let's personalize your content