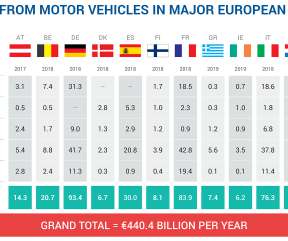

With gas phase-out in view, Europe could lose $160 billion in fuel taxes

Teslarati

JANUARY 30, 2024

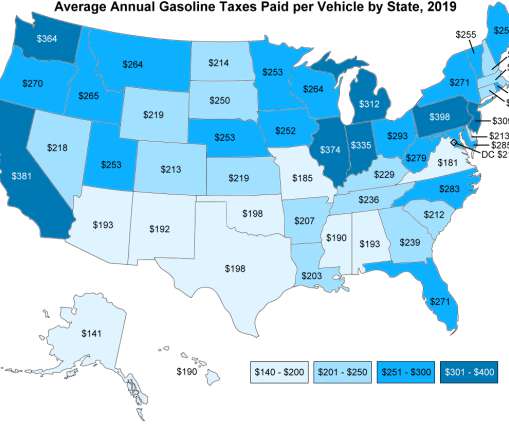

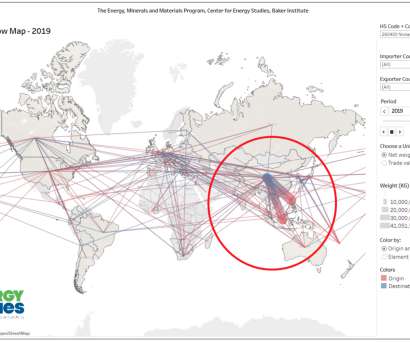

With Europe’s gas phase-out plans now within view, the countries there could be set to lose significant funding from fuel taxes in the coming years. Still, the change could have some latent effects, especially as most countries get crucial revenue from taxes on gas. What about in other countries?

Let's personalize your content