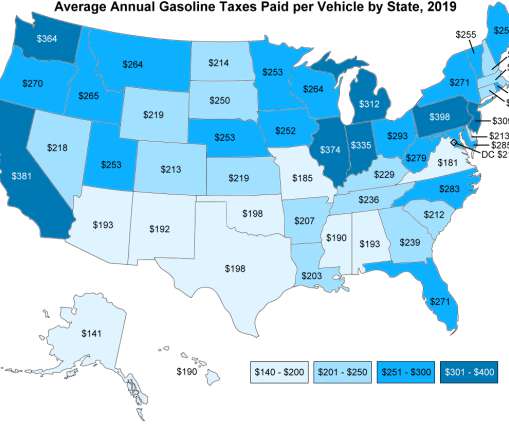

DOE: Average annual gasoline taxes paid per vehicle, by state, 2019

Green Car Congress

DECEMBER 3, 2019

According to the Federal Highway Administration, the average fuel economy for all light vehicles on the road today is 22.3 The Federal tax on gasoline is 18.4 cents per gallon, and each state has a gasoline tax, ranging from 8.95 Based on a vehicle with an average fuel economy of 22.3 cents in Alaska to 58.7

Let's personalize your content