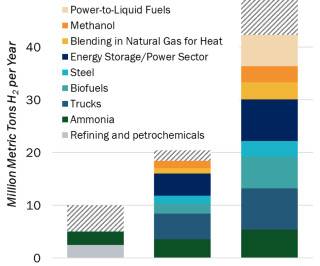

Biofuel and Ag organizations call for accountable life cycle analysis for SAF tax credits, DOE to lead

Green Car Congress

AUGUST 10, 2021

In an effort to decarbonize transportation and reduce aviation emissions, Congress is considering new legislation to establish a tax credit to promote and develop robust domestic SAF production. We urge you to make the US Department of Energy (DOE) the lead agency in establishing a regularly updated LCA for any SAF credit.

Let's personalize your content