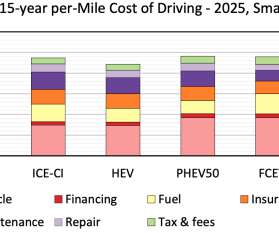

Study finds limiting warming to 2 °C would require at least a $200/t carbon tax globally

Green Car Congress

MAY 6, 2022

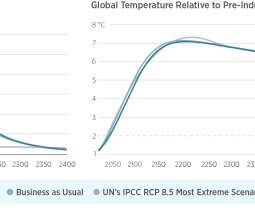

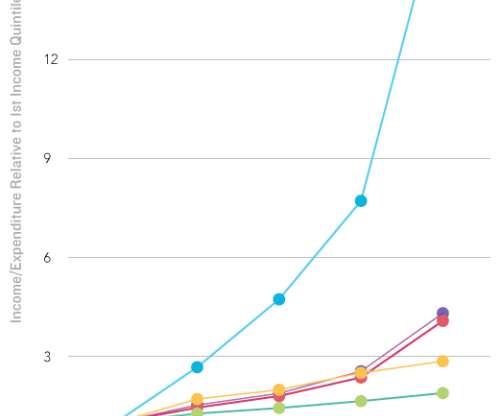

Lloyd Distinguished Service Professor in Economics, and José-Luis Cruz of Princeton University assesses the local social cost of carbon (LSCC) and how that cost aligns with the carbon reduction pledges countries made under the Paris Agreement. It measures the social cost in US dollars of adding a ton of CO 2 to the atmosphere.

Let's personalize your content