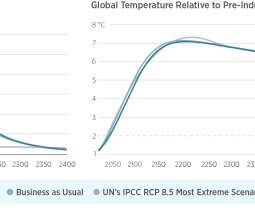

Study finds limiting warming to 2 °C would require at least a $200/t carbon tax globally

Green Car Congress

MAY 6, 2022

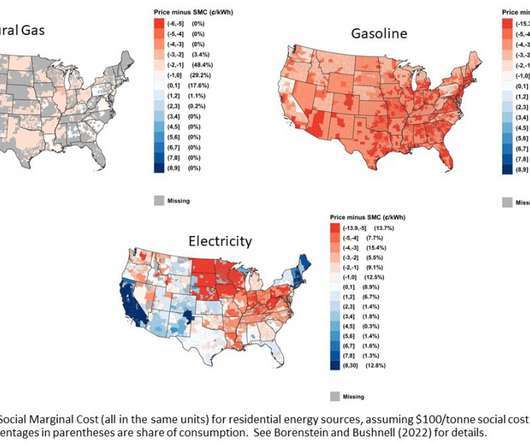

Some will suffer greatly from climate change, while others may even benefit. The social cost of carbon has become the standard measure to benchmark the magnitude of the carbon taxes needed to implement optimal carbon policy. Setting such a high tax on carbon is probably unrealistic, especially in developing countries.

Let's personalize your content