Why Labor’s new tax cut on electric vehicles won’t help you buy one anytime soon

The Driven EV News

JULY 31, 2022

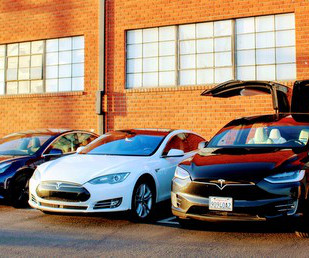

Labor says its electric vehicle tax cuts ar e“good for motorists, good for climate action and good for fleet purchases”. The post Why Labor’s new tax cut on electric vehicles won’t help you buy one anytime soon appeared first on The Driven. They won’t, however, help most Australians afford one.

Let's personalize your content