EVs Eligible for the Clean Vehicle Tax Credit

Electric Driver

MARCH 3, 2023

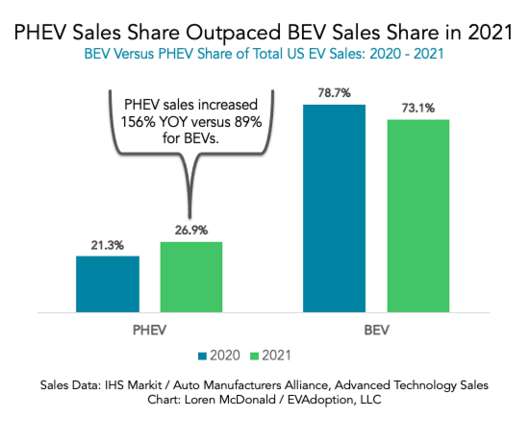

federal government is offering a clean vehicle tax credit to help promote the purchase of electric vehicles as an effort to reduce carbon emissions. The clean vehicle tax credit of up $7,500 depends on several factors. Here are some details on what is needed to qualify for the tax credit.

Let's personalize your content