Inflation Reduction Act mandates escalating battery critical mineral requirements to qualify for EV tax credit

Green Car Congress

AUGUST 9, 2022

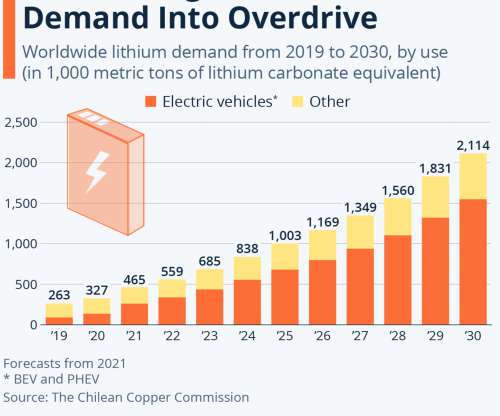

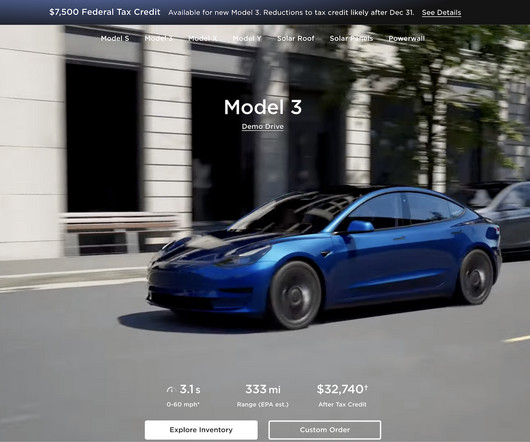

The Inflation Reduction Act , which the Senate passed last week, revamps the electric vehicle Federal tax credit of $7,500 ( earlier post ). 80% for a vehicle placed in service after 31 December 2026. It will also jeopardize our collective target of 40-50 percent electric vehicle sales by 2030.

Let's personalize your content