California reduces tax on dimethyl ether (DME) fuel to be consistent with other alternative fuels; enabling retail sales

Green Car Congress

SEPTEMBER 29, 2020

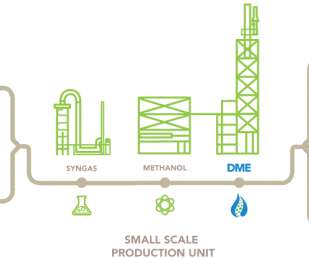

The California state legislature passed and the Governor signed into law a bill ( AB-2663 ) that lowers the Use Fuel Tax rate of dimethyl ether (DME) from $0.18 per gallon of DME-propane fuel blend used on or after 1 July 2021 (the same tax rate as propane, $0.06 per gallon of DME used and $0.06 per gallon).

Let's personalize your content