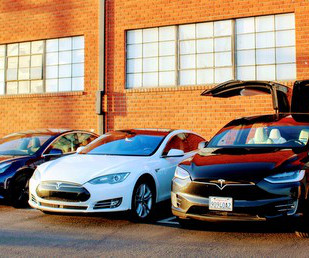

New Electric Vehicles Qualify for Federal Tax Credit

Green Energy Consumers

APRIL 26, 2024

As spring 2024 unfolds, we have some good news: more vehicle models are now eligible for the federal tax credit than when the list changed on January 1. Department of Energy recently released a new list of EVs that receive between $3,750 and $7,500 in federal tax credit.

Let's personalize your content