An Overview of Charging Incentives in Oregon

EV Connect

SEPTEMBER 11, 2023

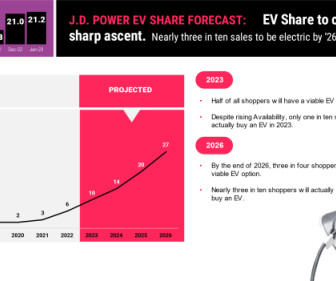

As electric vehicles (EVs) gain popularity, governments and utility companies are actively encouraging their adoption by offering a range of incentives. Oregon is no exception, with various charging incentives available to both businesses looking to install EV charging stations and EV owners.

Let's personalize your content