Kentucky electric cars now pay two taxes where gas cars only pay one

Baua Electric

JANUARY 1, 2024

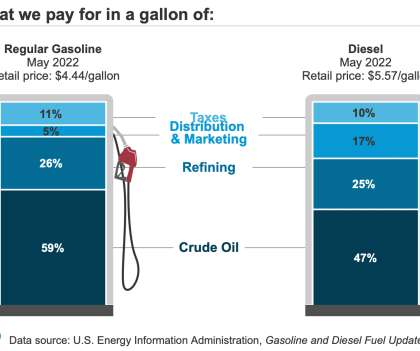

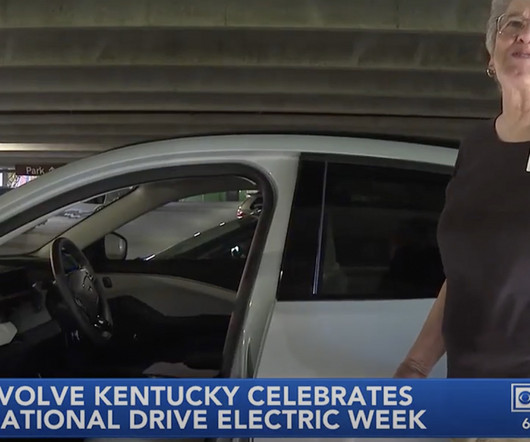

Photo by Mobilus in Mobili on Flickr As of January 1st, Kentucky has implemented not one but two new taxes on electric vehicles, both of which are individually higher than what gas vehicles pay on similar units of energy. cents, compared to a current average gas price of $2.78 per gallon in the state).

Let's personalize your content