Texas reinstates incentives for electric and alternative fuel cars

Green Car Reports

JUNE 4, 2018

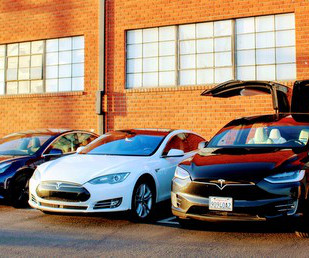

After a three-year hiatus, Texas has reinstated purchase rebates for plug-in electric and other alternative-fuel vehicles. Texans who buy electric cars after Sept. 1 can get a $2,500 rebate from the state, according to a report in the Dallas Morning News, in addition to the $7,500 tax credit from the federal government.

Let's personalize your content