Airbus exploring hydrogen fuel cell propellor “pods” for aircraft propulsion

Green Car Congress

JANUARY 3, 2021

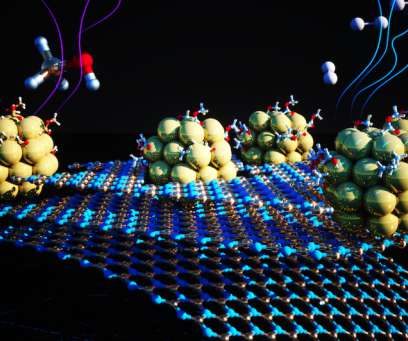

Airbus is conducting studies to determine how scalable a hydrogen fuel cell “pod” configuration, among others, could be to large commercial aircraft. The aviation industry has developed numerous configurations—twinjet, s-duct, winglets, contra-rotating propellers—over the last five decades that have enabled aircraft to fly higher, faster and longer.

Let's personalize your content