US COVID-19 mitigation efforts resulting in significant decline in traffic, emissions and fuel-tax revenues

Green Car Congress

MAY 2, 2020

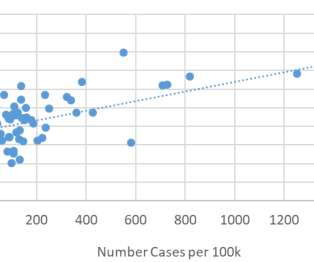

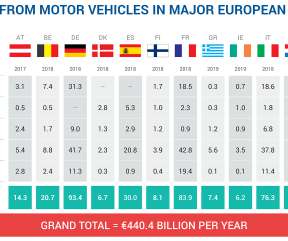

A new report from the Road Ecology Center at the University of California, Davis has found that total US vehicle miles traveled (VMT) at the county and state level have declined by 61% to 90% following the various government stay-at-home orders in response to the COVID-19 pandemic. Fuel saved, tax revenue lost. billion per week.

Let's personalize your content