US COVID-19 mitigation efforts resulting in significant decline in traffic, emissions and fuel-tax revenues

Green Car Congress

MAY 2, 2020

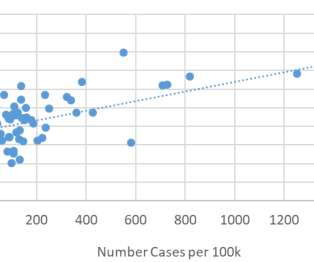

Greenhouse gas emissions reductions from road transportation were down across the United States from early March to early April 2020. (UC Fuel use dropped from 4.6 It also resulted in fuel-tax revenue reductions, which vary by state. UC Davis Road Ecology Center). billion gallons in early March to 1.3 billion per week.

Let's personalize your content