CMU study finds taxes on emissions would result in more rapid electrification by ridesharing companies

Green Car Congress

FEBRUARY 23, 2021

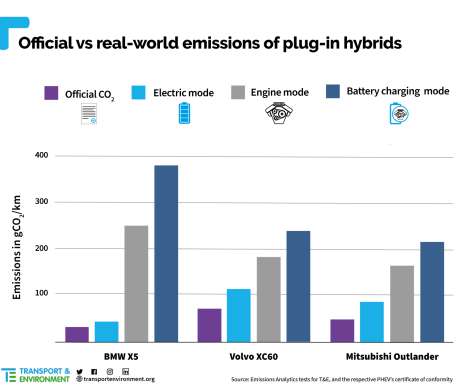

When life cycle air pollution and greenhouse gas emission externalities are internalized via a Pigovian tax, fleet electrification increases and externalities decrease, suggesting a role for policy. Air pollution is a classic case where free markets fail. —Bruchon et al. Source: Bruchon et al.

Let's personalize your content