Biden Administration mulls over reprieve from EV tax credits for automakers

Teslarati

NOVEMBER 29, 2023

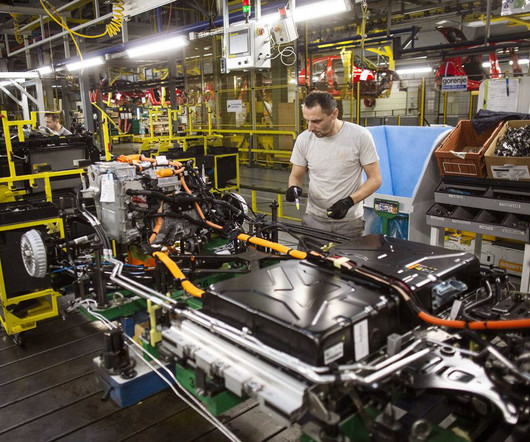

One of the biggest concerns about the IRA’s requirements for EV tax credit eligibly regards battery packs, cells, and the materials used to manufacture them. In March, the United States Department of Treasury published the battery sourcing guidance, which automakers must comply with to reap the tax credits from the IRA.

Let's personalize your content