Electric Vehicle Federal Tax Credit: Explained

Electric Driver

SEPTEMBER 3, 2022

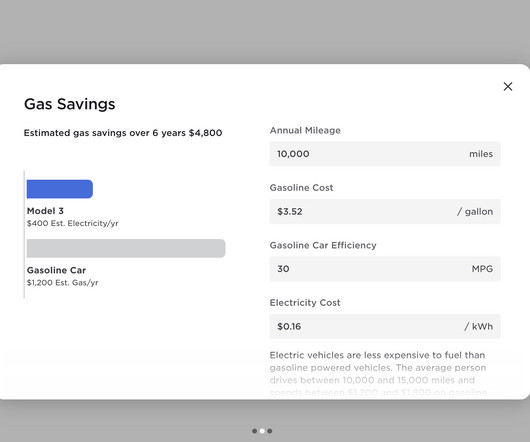

You may be wondering what is an electric car federal tax credit. The US government provides people incentives to switch from gas to electric cars and will give you up to a $7,500 tax credit to make the change.

Let's personalize your content