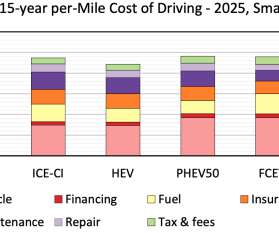

DOE labs study on costs and benefits of new transportation technologies the most comprehensive to date

Green Car Congress

AUGUST 14, 2021

There has been a lot of past research on the cost of vehicles and the cost of fuel, but these other operating costs haven’t been studied in quite the same detail before. There has been a lot of past research on the cost of vehicles and the cost of fuel, but these other operating costs haven’t been studied in quite the same detail before.

Let's personalize your content