Volvo EX30 debut, base Model 3 tax credit, plugging in PHEVs: Today’s Car News

Green Car Reports

JUNE 7, 2023

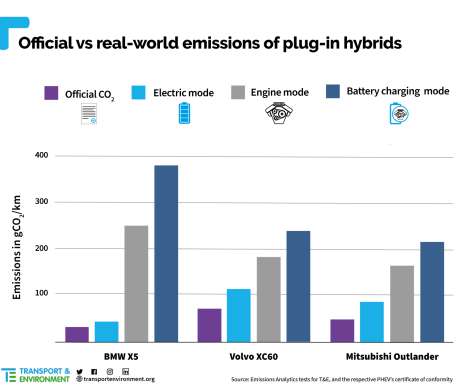

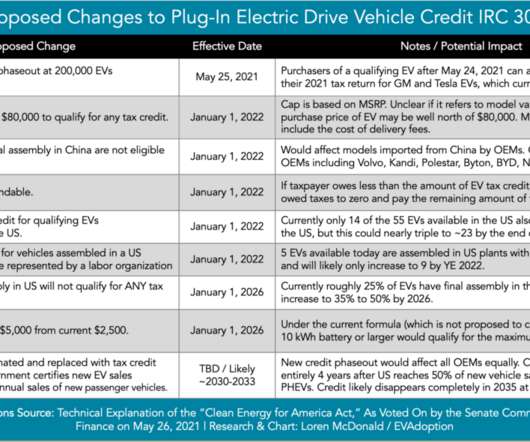

Base Standard Range versions of the Model 3 are eligible for more EV tax credit money than they were last week. And the Volvo EX30 EV aims for the $35,000 mark from the start. The Volvo EX30 EV will start around. Plug-in hybrid drivers likely aren’t plugging in as much as the EPA has been assuming.

Let's personalize your content