Upcoming Changes to the Clean Vehicle Tax Credit Explained

Blink Charging

NOVEMBER 16, 2023

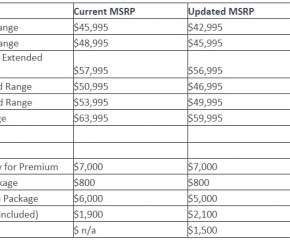

To encourage clean and energy-efficient vehicle adoption, the United States government has made significant changes to the Clean Vehicle tax credit, to take effect from January 1, 2024. These changes make it easier for drivers to access tax credits when purchasing clean vehicles. What Is the Clean Vehicle Tax Credit?

Let's personalize your content