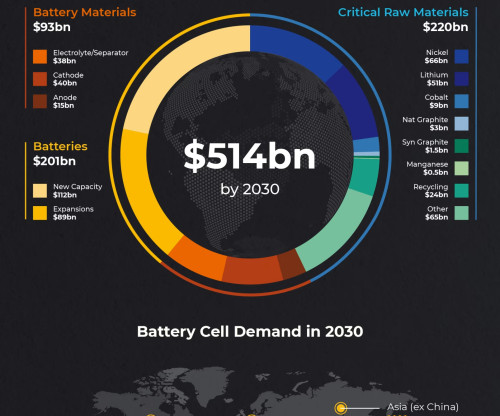

Benchmark: global battery industry needs to invest $514B to meet demand in 2030; $920B by 2035

Green Car Congress

JUNE 20, 2023

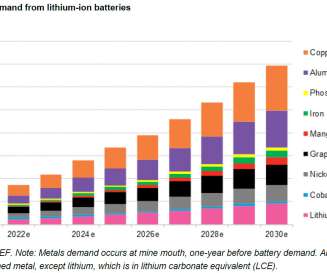

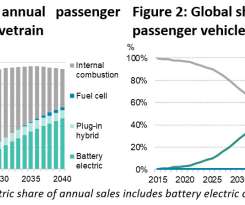

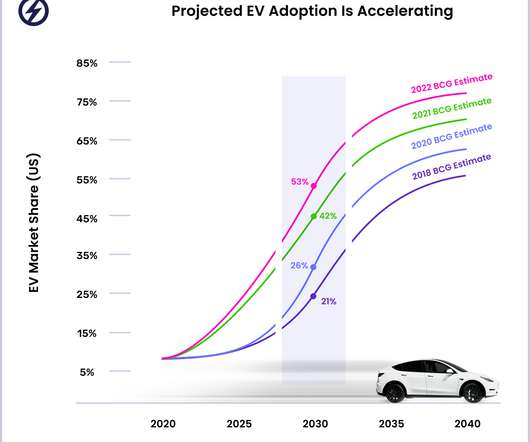

Globally, the battery industry needs to invest at least $514 billion across the whole supply chain to meet expected demand in 2030, and $920 billion by 2035, according to a new analysis by Benchmark. Demand for lithium ion batteries is forecast to grow to 3.7 TWh, as assessed in Benchmark’s Lithium ion Battery Database.

Let's personalize your content