Automakers handed a win with updated EV tax credit guidance in the U.S.

Teslarati

DECEMBER 3, 2023

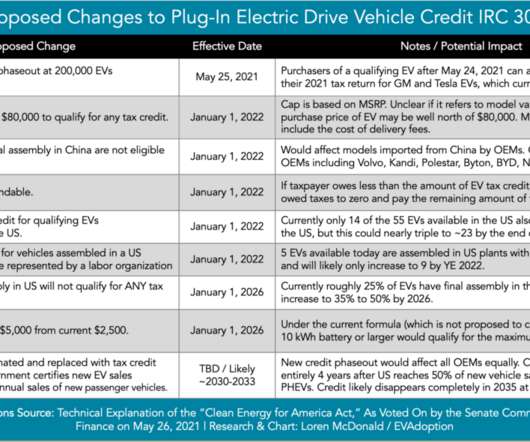

The White House issued new guidance on federal electric vehicle (EV) tax credits this week, including a key exemption that’s considered a win for many automakers, as it offers extra time for companies attempting to set up battery production operations in the U.S. to switch to domestic minerals. appeared first on TESLARATI.

Let's personalize your content