Used Teslas now qualify for $4k tax credit, but there’s a tough hoop to jump through

Teslarati

AUGUST 7, 2023

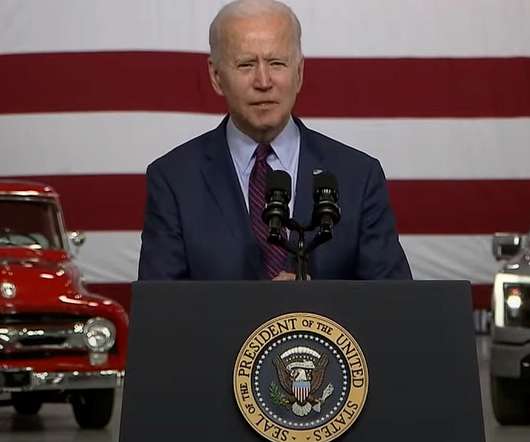

Used Teslas will now qualify for the $4,000 tax credit through the Inflation Reduction Act (IRA) that is applicable for electric vehicles (EVs), Plug-In Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). It must have a model year at least two years earlier than the calendar year when you buy it.

Let's personalize your content