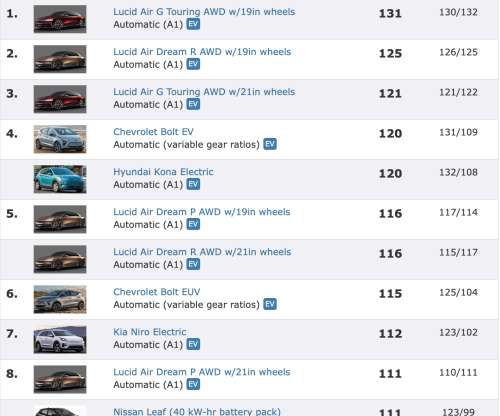

EVs dominate list of efficient cars in ORNL 2022 Fuel Economy Guide

Green Car Congress

NOVEMBER 18, 2021

The site provides consumers with information to help guide buying decisions for all types of vehicles, including current EV federal tax credits, as well as operation and maintenance tips to save drivers money. Consumers can personalize estimates for their annual miles and local fuel prices, for example.

Let's personalize your content