IRS invites consumers to comment on EV tax credit qualifications

Teslarati

JANUARY 3, 2023

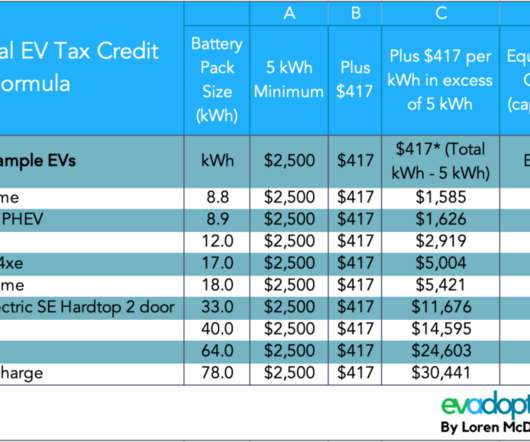

The Internal Revenue Service (IRS) is inviting consumers to share comments on the electric vehicle tax credit qualifications. Tesla and electric vehicle supporters have been vocal about the Inflation Reduction Act’s qualified cars for the EV incentive. Credit: IRS. Your feedback is welcome.

Let's personalize your content