J.D. Power: EV price pressure grows as government incentives and lease deals wield outsized influence on consumer demand

Green Car Congress

MARCH 30, 2023

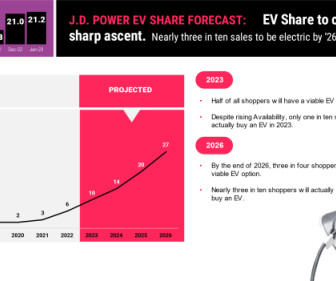

Due to a steady increase in availability of new models, expanded price mix within existing models and widening eligibility of federal and state incentives, acquisition cost is starting to fade as a hurdle to EV adoption, according to J.D. Additionally, both manufacturers recently announced significant price cuts on both models.

Let's personalize your content