Congressional Budget Office estimates US federal policies promoting EVs and other fuel-efficient vehicles will cost $7.5B through 2019; little or no impact on gasoline use and GHG in the short term

Green Car Congress

SEPTEMBER 21, 2012

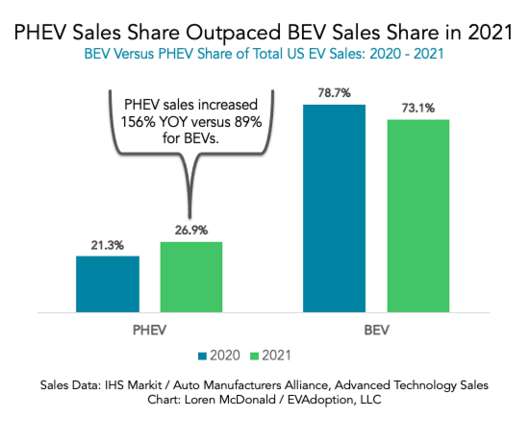

Tax credits and gasoline prices necessary for various electric vehicles to be cost-competitive with conventional vehicles at 2011 vehicle prices. For example, an average plug-in hybrid vehicle with a battery capacity of 16 kWh would be eligible for the maximum tax credit of $7,500. Source: CBO. Click to enlarge.

Let's personalize your content