Responsible Battery Coalition and U Michigan launch study to compare electric and gas vehicle lifetime costs

Green Car Congress

OCTOBER 31, 2022

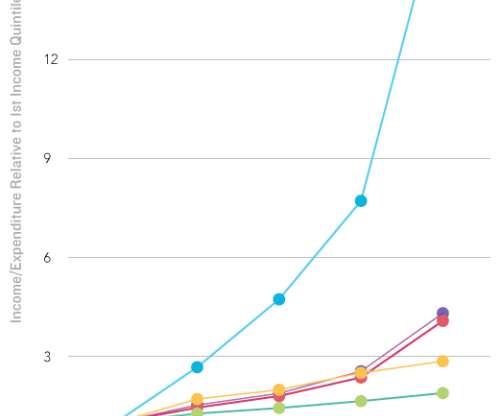

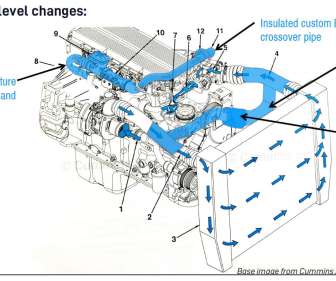

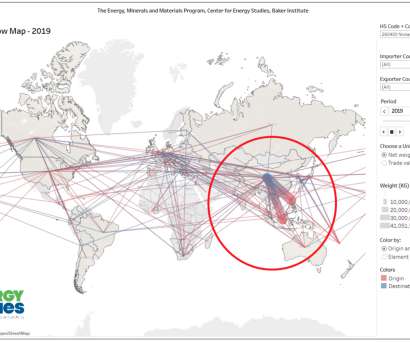

The Responsible Battery Coalition, in partnership with the University of Michigan Center for Sustainable Systems, launched a comprehensive research project to compare the total cost of ownership of gas and electric vehicles (EVs). Projections of future gasoline and electricity prices. Anticipated driving patterns.

Let's personalize your content