These are the EVs that still qualify for the $7,500 tax credit in 2024

Teslarati

JANUARY 2, 2024

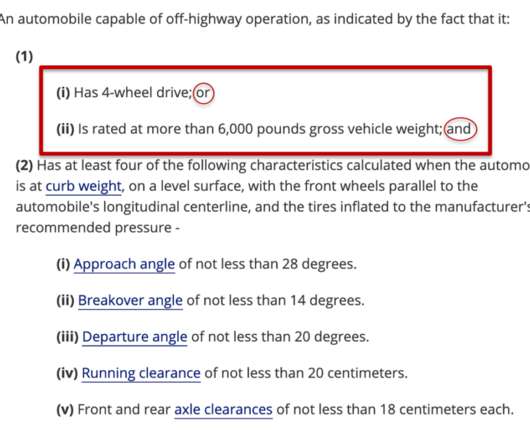

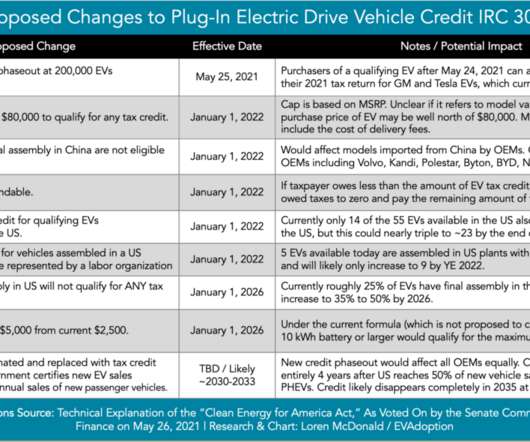

electric vehicle (EV) tax credit have taken effect, significantly limiting the number of qualifying options in 2024. Despite the list of qualifying EVs getting shorter , the 2024 guidance also lets sellers offer the rebate at the point of sale , rather than buyers being forced to wait until doing their taxes.

Let's personalize your content